A Guide to Cap Table Management

Cap table management is both a strategic and an operational task. This blog helps you understands both sides of it. We have also attached an ungated cap table template to help you get started!

Table of Contents

Cap table management isn't just about keeping tabs on who owns what. It's a strategic task with far-reaching implications.

A good way to understand this is via Chris Harvey's (a venture capital lawyer) experience when helping a client lead their Series A round. They came across a super complicated cap table with things like convertible debt, warrants, participation rights, and liquidation preferences greater than 1x. This was the founder’s third start up.

Upon talking to the founder, they realized—An early investor and former landlord has been supporting him since his first company—a venture that had a large exit. After the exit, the founder even bought their former landlord’s property and she invested in his second start-up, which didn’t work out. The founder didn't want to let down his early supporters, so he found a way to give them a stake in his third venture.

You see how complicated this is getting?

While some VCs may be okay with founders carrying ‘old baggage,’ others might tread carefully. Either way, the deal terms will change a lot because the new investor would want to protect their investment.

As a founder, you must guard your cap table at all costs. Avoid getting caught between investors and risk losing sight of your company's goals. If you get this right, managing equity operationally shouldn't be hard.

Cap table meaning

Cap tables serve as a central source of truth, summarizing the stock ownership of founders, investors, and employees. When a company issues new shares or grants stock options, existing shareholders' ownership percentages dilute. The cap table keeps track of these changes over time and shows how the company's value and ownership structure evolve.

A cap table allows you to gauge the true worth of the company at different points in its journey. This helps you make informed decisions about future fundraising efforts.

Here's a sample cap table for your reference:

Why should you have a cap table?

Startups and investors rely on cap tables to gain clarity on ownership structure and make informed decisions about their next steps.

Cap table management for companies

1. Clarity for complex ownership structures

As your company grows, ownership structures can become tangled. New investors come on board, stock options are granted to employees, and there may be offers for mergers or acquisitions. A cap table captures all of this information, ensuring everyone - founders, investors, and employees - has a clear understanding of their stake and associated rights. This reduces conflicts and prevents surprises regarding ownership dilution down the road.

2. Informed decision-making

Your cap table provides valuable insights. For example, an increase in the value of equity over time, despite dilution from new investments, suggests the company is growing and generating returns. Additionally, if a significant portion of ownership is held by key employees or early investors, it indicates strong support for the company's growth path.

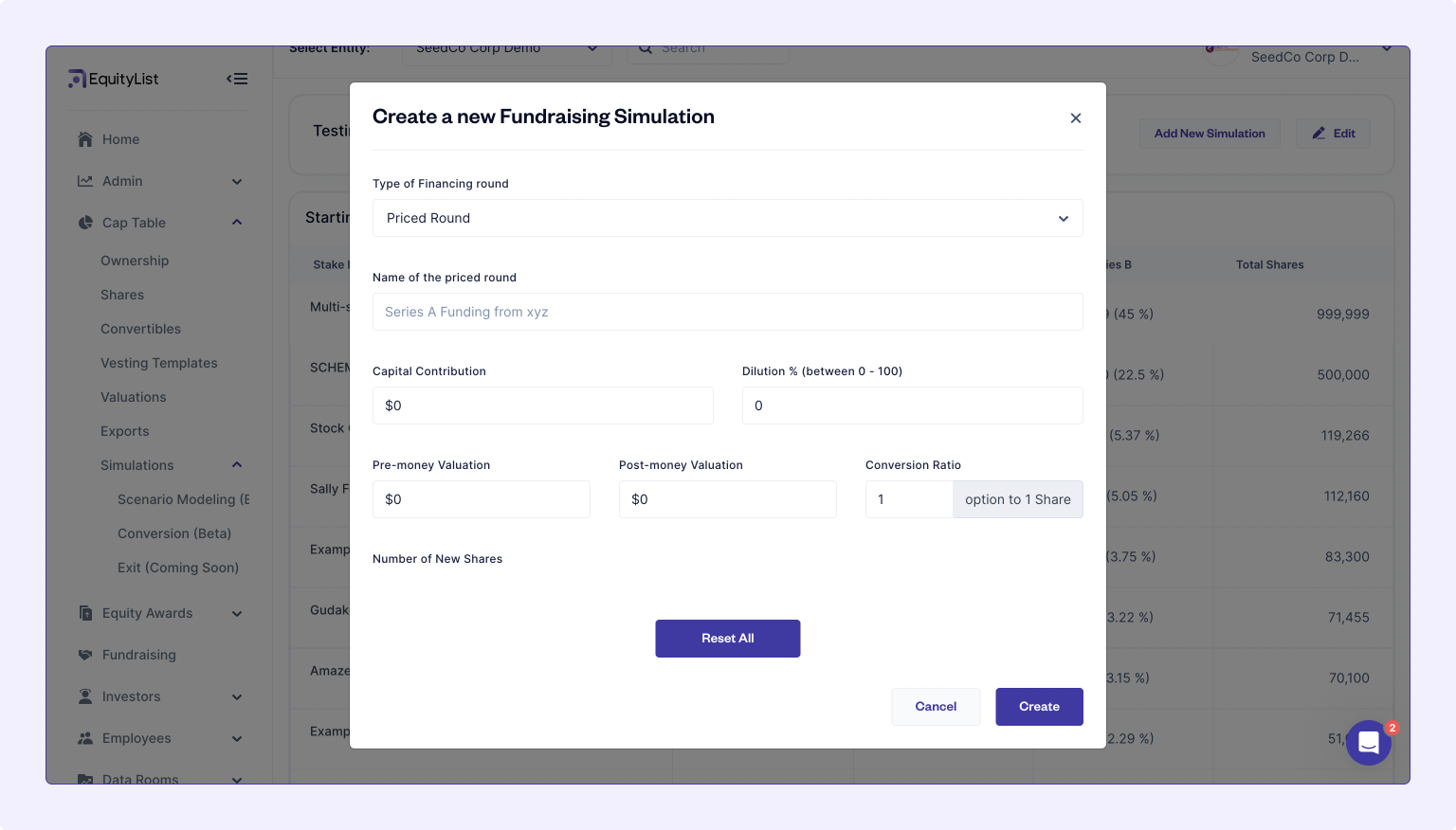

3. Term sheet negotiation using simulations

A well-organized cap table simplifies term sheet negotiations. By running simulations for various funding scenarios, you can anticipate negotiation points, understand trade-offs, and devise better strategies. You can see how different scenarios impact ownership, company value, and dilution.

4. Saves time and resources

Without a cap table, your compliance and finance teams would spend significant time sifting through emails and documents to gather ownership information when needed. Cap table data is essential for conducting due diligence before funding rounds, facilitating mergers and acquisitions, ensuring compliance reporting, and communicating with shareholders.

5. Legal safeguards

In the United States, a cap table serves as a legal record to confirm ownership rights. It is relied upon in instances, such as disputes between shareholders or in the event of an acquisition or merger. Additionally, it helps ensure compliance with regulatory requirements, including securities laws, and facilitates accurate reporting to regulatory bodies

Read more on cap table management for startups.

Cap table management for investors

Cap tables are crucial for investors to evaluate the potential value and risks of investing in a startup.

1. Investment clarity

A cap table helps investors gain insight into their potential investments. If it shows too much dilution too early, that could mean issues such as unsustainable growth strategies, mismanagement of funds, or lack of clear direction. It also restricts the company's ability to raise future capital.

Furthermore, the number of investors on the cap table matters. If there are too many investors with varying priorities and preferences, it can be challenging for the company to make decisions that satisfy all parties. It could also slow down decision-making, and complicate negotiations for future funding rounds.

2. Exit strategy insights

From the outset of their investment journey, investors assess potential exit strategies. This includes contemplating scenarios like acquisition by another company, an Initial Public Offering (IPO), or sales in the secondary market.

When looking at the cap table, they analyze how each scenario could unfold, taking into account the existing ownership structure and investor rights.

For example, if a company has a lot of debt from creditors, investors would accordingly negotiate terms with the company to improve their position. They may ask to restructure debt agreements or prioritize equity investors in certain scenarios. This is because creditors have priority over equity investors in the event of a liquidation or sale of the company.

3. Monitoring progress

Investors can map historical changes in the ownership structure of a cap table to key milestones of the company. This helps them assess the company's efficiency in translating capital into growth and value creation. Through ongoing monitoring, investors can also identify trends and pinpoint areas for improvement. This enables them to actively contribute to the company's growth.

4. Identification of red flags

A cap table helps spot potential problems in a company's ownership setup.

For instance, if there are $1 million worth of convertible notes with no floor in a company’s cap table, they could potentially convert into equity at a valuation much lower than expected, leading to significant dilution for existing shareholders.

Similarly, if the ownership structure is complicated with many different types of shares, it could make fundraising or acquisition difficult. This might scare away investors who prefer simplicity.

5. Benchmarking

Investors use cap tables as a benchmark to evaluate the attractiveness of an investment opportunity within the broader industry.

For example, a higher pre-money valuation compared to similar startups may suggest that the startup is perceived as having greater potential by investors. However, it could also imply a riskier proposition, as a higher valuation may lead to higher expectations for performance and returns.

Read more about cap table management and how to do it right.

Cap table components

Now that you know how important it is to have a well-documented cap table, let's help you create one. Here's a list of all the essential information a cap table should include:

1. Securities

A company usually issues various types of securities with specific rights and privileges:

a. Common stock: This is the most basic form of ownership. Common stock grants voting rights and the right to share in the company's profits (if any) after dividends are paid to preferred stockholders. Founders typically hold a significant portion of common stock initially.

b. Preferred stock: Preferred stock gives investors special privileges over common stockholders. These include dividends and liquidation preferences. In case of liquidation or bankruptcy, preferred stockholders get priority in receiving proceeds from asset sales.

c. Employee stock options: Employee stock options are contracts that give the holder the right, but not the obligation, to buy a set number of shares of common stock at a fixed price (strike price) by a specific date (exercise date). They're often used to incentivize employees and attract talent. Options usually vest over time, with ownership of the shares granted to the employee once certain conditions are met.

d. Warrants: Warrants could be provided to investors as an incentive during fundraising rounds or when a company takes on debt. They offer investors an extra advantage by granting them the option to buy additional shares of the company's stock at a predetermined price in the future.

e. Convertible notes: These are essentially debt instruments that convert into equity upon the occurrence of a triggering event, such as a future funding round or reaching a specific milestone. Convertible notes are a popular choice for early-stage financing because they allow for flexibility in valuation.

f. SAFEs (Simple Agreements for Future Equity): They are a simplified form of a convertible note. SAFEs are commonly used in very early-stage financing rounds. They defer valuation to a later funding round, making them attractive for both startups and investors with limited due diligence resources. A SAFE is a contract that offers investors the right to obtain equity in a future financing round, while a convertible note is a debt instrument that can convert into equity at a later date.

2. Ownership tracking: shares, percentages, and dilution

After you list all the securities your company is currently dealing in, the next step is to determine the ownership of each type of security.

a. Authorized shares

- This is the maximum number of shares a company can ever issue, set during incorporation. However, authorized shares can be increased later after board consent and amendment to the Memorandum of Association (MoA).

- It does account for reserved shares and of which option pools are part.

- Authorized shares are a sum total of common stock and preferred shares the company can issue.

b. Outstanding shares

- These are the shares that have been issued to investors and employees from the pool of authorized shares.

- They represent the current ownership of the company.

c. Reserved shares

- These are authorized shares that are set aside for a specific future purpose, like employee stock options or stock purchase plans.

- They are not yet outstanding and only become so when exercised in the case of options or purchased in the case of stock purchase plans.

d. Number of shares in a cap table (by security type)

- This reflects the total number of outstanding shares for each type of security (common stock, preferred stock, etc.).

- It doesn't include authorized shares or reserved shares because reserved shares are already counted within the authorized limit.

e. Ownership percentage

This translates the number of shares held by each stakeholder (founders, investors, employees with options) into a percentage of the total company ownership. As the company issues more shares, the ownership percentages of existing shareholders will decrease or in other words dilute.

f. Price per share

This reflects the price at which each share was issued. Tracking historical share prices for different funding rounds is crucial for understanding dilution. For example, if a company issues new shares at a lower price than previous rounds, existing shareholders experience greater dilution.

g. Fully diluted shares

This scenario assumes that all outstanding options and warrants are exercised, reflecting the maximum potential dilution for existing shareholders. This helps founders and investors understand the ultimate ownership structure after all potential conversions and exercises occur.

3. Valuation details

a. Pre and post-money valuation

Pre-money valuation represents the company's worth before external funding, while post-money valuation reflects its value after funding rounds.

Post-money valuation = pre-money valuation + investment amount.

You must track pre and post-money valuations for all funding rounds.

4. Investor information

The cap table also tracks identification details of investors such as:

a. Investor name

b. Investment amount

c. Share certificates

d. Address, contact

5. Date of issuance

You need to also track the issuance dates for securities. This is relevant for vesting schedules of stock options or conversion triggers for convertible notes.

6. Additional considerations

Complex financing structures might involve additional details in the cap table, such as:

a. Anti-dilution provisions

These protect investors from excessive dilution by requiring the company to issue them additional shares or lower their conversion price if the company raises capital at a lower valuation in a future round.

b. Liquidation preference

This specifies how preferred stockholders are compensated in case of the company's sale or bankruptcy. Different classes of preferred stock may have varying liquidation preferences, with some requiring a multiple of their investment amount before common stockholders receive any payout.

c. Information rights

This grants certain investors access to specific company data and financial information. The scope of information rights can vary depending on the type and size of the investment.

How to create a cap table for your startup?

While spreadsheets are a common starting point for managing cap tables, it may not be the most efficient tool for the job. We recommend transitioning to a more advanced software solution to effectively manage stakeholders and ensure compliance. More on this in the next section.

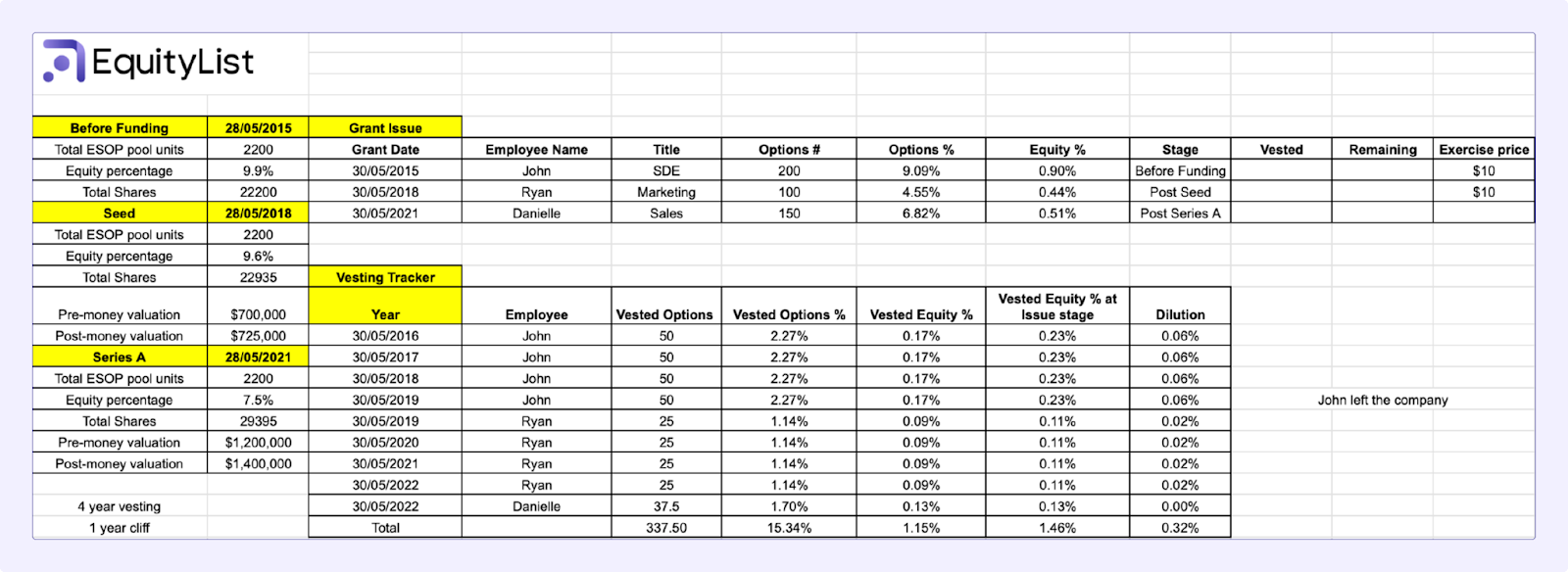

Assuming your startup initially had two founders, Alex and Maria, with 45% equity each and an ESOP pool of 10%. They then raised $25,000 from an angel investor, David, in their seed round at a pre-money valuation of $700,000.

This is how their cap table would change after their seed round. Their new share price (FMV) is now $32, with 3.4% (781 shares) allocated to David for his capital. One thing to note here is that the share of existing shareholders diluted to accommodate David, and they now own 3.4% less than they used to. Share price is calculated by dividing the company's pre-money valuation by the total number of shares in the company at the time of funding.

Get the cap table template. Make a copy of it to customize based on your needs.

The same process would be replicated when you raise further rounds.

However, things start to get messy when you begin assigning ESOPs to employees from the pool. You will need to have a separate tab linking back to this sheet that tracks all your employees' vesting schedules. Additionally, consider what would happen when you start raising funds through convertible notes and SAFEs. The calculation becomes even more complicated if your investors start asking for anti-dilution protection and other rights.

The following cap table provides just a glimpse of the complexity without factoring in the nuances that stock options could have been issued on different timelines, with varying vesting schedules, and investors could have anti-dilution protection, etc.

This is why we don’t recommend using spreadsheets for cap table management. It’s super cumbersome, and very difficult to figure out if you've made an error in the calculation.

Excel cap table Vs Cap table software

The above cap table is extremely oversimplified. In reality, founders raise debt, involve multiple angel investors and hundreds of employees, and may also have multiple convertible notes and SAFEs. Additionally, the company could either be a subsidiary or have subsidiaries - all of which can make your cap table convoluted.

Managing this on a spreadsheet is error-prone and can lead to losses and faulty decisions, given the sensitivity of the data. A software streamlines this in a consumable and accurate fashion.

Some scenarios in which cap table management software can streamline various aspects of your business include:

1. Mergers, acquisitions, and IPOs

These are some of the most significant milestones in a company's lifetime. Companies spend years working towards this stage, but without an accurate and detailed cap table, this dream can only remain a dream.

Cap tables are also important for scenario modeling and softwares usually have this function built in. Simply enter the scenario you want to model, and a dummy cap table will be generated in minutes.

2. Corporate restructuring

As startups undergo corporate structure changes, such as transitioning from an LLC to a C-Corp in the United States or moving from a Private Limited Company (PVT LTD) to a Public Limited Company (PLC) in India, cap table management software helps handle these transitions seamlessly.

Moreover, it facilitates multi-entity management for companies with subsidiaries or multiple entities. This feature enables founders to track ownership across different entities, ensuring accurate reporting and enhancing transparency for stakeholders.

3. Secondary offerings

When startups want to give their early backers or employees a chance to cash out some shares, they might conduct a secondary offering. However, doing this in a spreadsheet is challenging. You have to figure out how it affects existing shareholders and the distribution of funds. Cap table management software performs these calculations instantly and also integrates with your finance software for disbursal of funds.

4. Convertible notes and SAFE conversions

Manually managing conversions from convertible notes or SAFE agreements with varying terms into equity can be complex. However, software is built to handle these complicated exchanges. It not only manages the calculation but also ensures that the beneficiary receives their intended stake.

5. Equity compensation planning

Handling equity grants, vesting schedules, and employee stock options manually for even five employees is challenging. Since the software already has your fundraising data, it is much easier to allocate stock options. Additionally, each employee's issue date could vary, and they could vest on different dates. Tracking how much each employee stake has vested at any point in time means you will have to monitor this daily. This can be overwhelming for your finance teams.

Beyond this, software also automates exercising and buybacks.

6. International compliance

As startups onboard advisors and employees from across the globe, managing options becomes increasingly complex due to diverse regulations across jurisdictions. Cap table management software plays a crucial role in accommodating this complexity by considering factors like multiple currencies, tax implications, and country-specific regulations. This ensures compliance and minimizes the risk of legal issues for companies with globally distributed teams.

To sum up, cap table software proves to be a wiser choice in the long run over spreadsheets. It's faster, more accurate, and helps with all the tricky stuff that comes with growth.

Best practices for cap table maintenance

Often, people create a cap table but overlook the importance of updating it regularly. Here are some key events when it's crucial to revisit your cap table and ensure it's up to date.

1. Pre- and post-funding rounds

Review and update the cap table before and after each funding round to accurately reflect changes in ownership due to new investors and additional shares issued.

2. Annual updates after valuations

Private companies periodically conduct valuations, such as 409A in the US or FMV assessments in India, to determine the fair market value of their shares. Ensure the cap table is updated after these valuations.

3. Quarterly reviews

Regularly review the cap table to update changes in employee stock options, ESOP grants, and option pools to maintain transparency.

4. Post-employee equity events

Update the cap table after significant employee equity events, such as promotions or terminations, to reflect changes in ownership.

5. After investor relations activities

Incorporate changes in ownership resulting from investor updates, board meetings, or discussions with potential investors into the cap table to ensure alignment with stakeholders.

6. Upon stock splits or dividends

Adjust the cap table to reflect changes in share count and ownership percentages following stock splits or dividend distributions.

7. During equity buybacks or repurchases

Update the cap table to reflect reductions in outstanding shares resulting from equity buybacks or repurchase programs.

8. After stock option exercises

Reflect the conversion of stock options into shares in the cap table following exercises by employees or investors.

Cap table management mistakes

If we've discussed best practices, it's only fair to cover some common cap table mistakes as well.

1. Avoid verbal agreements

While handshake deals with investors might seem friendly, they can cause confusion and disputes later on. Imagine negotiating an investment with an angel investor who agrees to a 10% ownership stake for their $100,000 investment. Without a formal agreement, both parties might have different interpretations of the terms, particularly regarding liquidation preferences or conversion rights.

2. Keep shareholder information updated

Keeping your shareholder data up-to-date is crucial. Imagine a scenario where you need to distribute dividends to your shareholders, but you have outdated contact information for one of them. This can not only delay the process but also create frustration for the missing shareholder.

3. Pay attention to decimals

Be mindful of share allocation with decimals, especially when dealing with large numbers of outstanding shares. Rounding errors, even seemingly insignificant ones, can lead to discrepancies in ownership percentages.

4. Address waterfall concerns

For companies with complex liquidation preferences, such as waterfall structures, it's important to ensure that your cap table accurately reflects these preferences. Liquidation preferences define the payout order for shareholders during an exit event. Errors in waterfall calculations can result in disagreements among shareholders.

5. Carefully negotiate the option pool

A well-designed stock option pool is essential for attracting and retaining talented employees. However, deciding when to carve out this pool from the company's ownership can significantly impact existing shareholders.

Negotiating the option pool pre-money means setting it aside before any new investments. This concentrates the dilution on the founders. A post-money option pool, on the other hand, takes a slice of the ownership pie after new investments come in. This spreads the dilution between founders and investors.

6. Avoid mispriced option grants

Setting a fair strike price, also called the exercise price, for employee stock options is critical. A low price saddles employees with unexpected tax burdens when they exercise their options, while a high price discourages them from participating altogether. To avoid this, a fair market valuation is highly recommended.

Best cap table software

If you've made it this far, you know almost everything there is to know about cap table management! Here are some of the top cap table management software options to get started with:

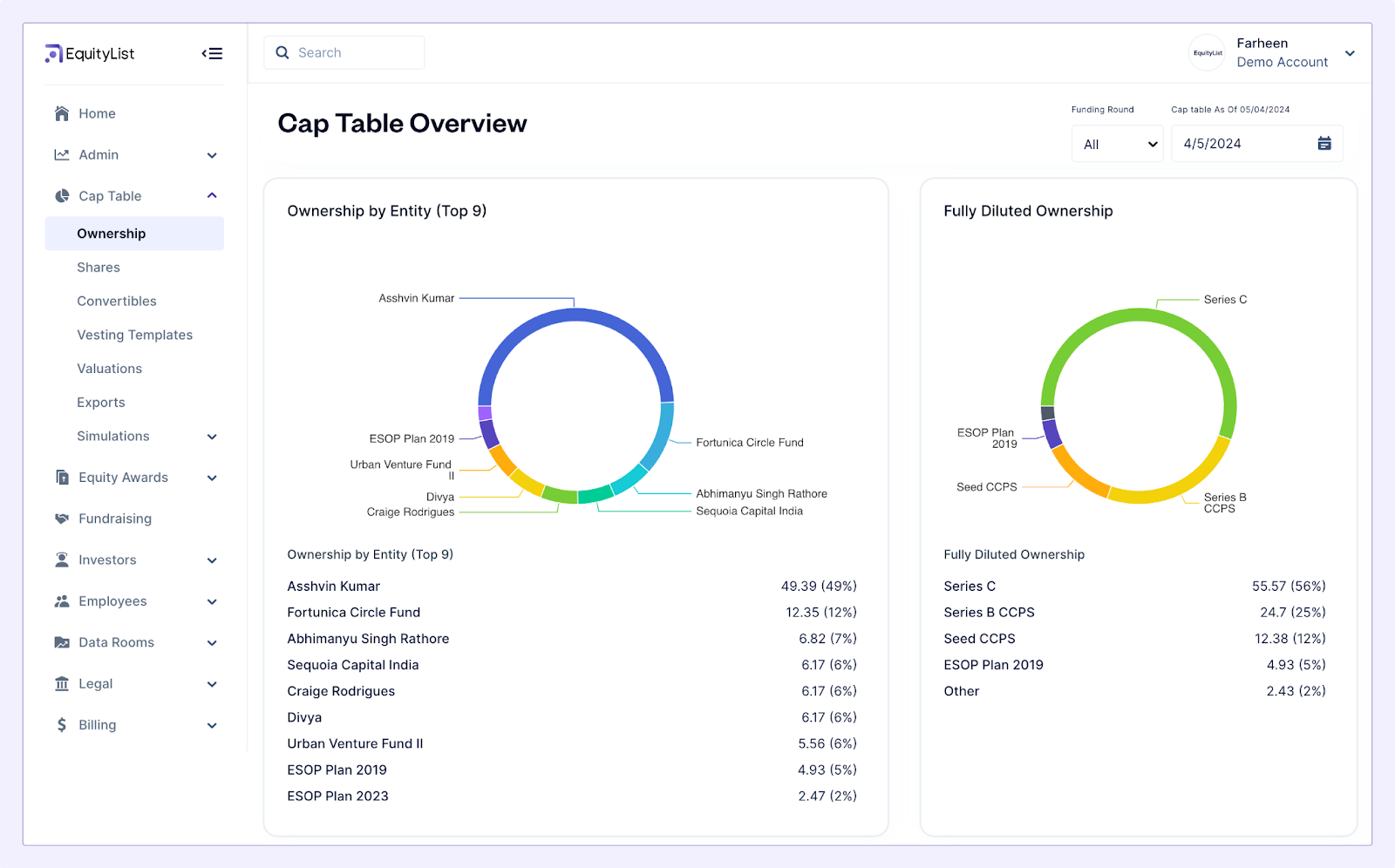

1. EquityList

EquityList empowers founders by simplifying cap table and shareholder management for startups. We want builders to focus on innovation and growth, while we handle fundraising, governance, equity, and compliance through our all-in-one platform. Trusted by over 300 companies, including Cars24, Slice, and Shiprocket, we manage more than $1 billion in equity.

The platform is free to use if you are managing fewer than 25 stakeholders and have raised less than $1 million. Once you exceed this threshold, you can upgrade to the Seed plan for $2,200 per year and manage over 50 stakeholders.

Learn more about our cap table management tool.

2. Ledgy

Ledgy is a Switzerland based start up that primarily serves professional service, private equity backed and public companies. They help them design and automate workflows to save time and resources.

On their free version, you can manage up to 25 stakeholders. After that, you are charged €3 per stakeholder per month.

3. Pulley

Pulley is mostly popular among Y-combinator companies for all their cap table management needs.

Unfortunately, they don’t offer a free plan. They charge $1,200 per year for managing up to 25 stakeholders. However, they do offer a 14-day trial period and 1 year free subscription for Y-combinator companies demoing that year.

4. Carta

Carta is a leading cap table management platform used by over 40,000 companies. It simplifies tracking ownership changes, storing important documents, and granting stock options to employees.

However, some clients find Carta's diverse offerings to slow down operations. They also don’t offer a free plan, and their base version starts from $2,800 per year.

Thinking about your cap table both operationally and strategically is important. It could truly become your moat. Hope you found this blog helpful, and here's to laying a solid foundation for your company's success!

.svg)

.webp)