EquityList Product Updates

Comprehensive cap table ledger report

EquityList now provides a Comprehensive Cap Table Ledger export that consolidates all relevant information into a single report. This report, accessible under Cap Table > Exports, offers detailed insights, from ESOP grants to share certificates, and share classes.

What’s included in this report?

- Summary and detailed cap table: The report’s first two tabs provide a summarized view of the cap table, followed by a more detailed breakdown of shareholder holdings and equity distribution.

- Equity certificates by share class: Separate tabs are provided for each share class, including Equity, Seed, Series A, Series B, etc., making it easy to view equity certificates organized by class.

- Convertible instruments: The ‘Convertibles’ tab captures details for convertible notes and SAFEs, with fields for type, capital contribution, discount, conversion date, and linked share certificate ID for converted instruments.

- ESOP and SAR grants: Dedicated tabs provide an overview of ESOP and SAR grants, including vesting details. Additional fields such as federal exemption and state of residence are included where applicable for compliance.

This all-in-one report is designed to streamline cap table management, offering a holistic view for easy reference and decision-making. Any feedback is welcome as we continue refining this enhancement!

MAJOR upgrade to the exercise workflow

We might have outdone ourselves with this one … 👀

The entire exercise workflow has gone through a major upgrade to provide a consistent and complete experience for both admins and grant holders.

Employee side:

- Enhanced tax calculation and total payable breakdown: With a fresh coat of paint, we do a better job of clearly breaking down the total payable amount by the grant holder for an exercise transaction. Admins can also directly mention the specific tax bracket relevant for stakeholders to directly calculate the tax liability on exercise transactions.

- Confirmation of bank account and transaction details: Employees can now select primary bank account related to exercise transactions along with other details such as demat information (for Indian companies) and ‘lock-in’ their exercise request to finalize on the exercise quantity and payable amount.

- Add-multiple payment tranches for cheque and wire transfers: Ability to add multiple payment details and proof support in case of an offline transaction via cheque or direct wire transfer to the company’s bank account.

- Standardized exercise letters: The process uses EquityList’s standard exercise letter templates, ensuring consistency across users.

[Note: Custom exercise letters are available to customers on our ‘Scale’ pricing plan.]

Admin side:

- Editable exercise requests: (Equity Awards > ESOP Exercises) Admins can edit exercise requests to update details before locking them for approval. These requests then move to a ‘Pending Approval' state, offering an extra layer of review.

- Added ‘View Beneficiary Bank Details’: For admins, beneficiary bank details are now visible during the approval process.

- Admin-initiated requests: Admins can create draft exercise requests on behalf of employees, which employees can later review, consent to, and complete. This streamlines workflows for cases where employees need additional support.

- Reconcile offline transactions: Finance admins get a lot more flexibility in reconciling offline transactions on the platform with the ability to flag transactions as well in case of incorrect or partial transfers.

We've also embedded a payment gateway in the flow:

- Pay via UPI, Net Banking or debit card: We have now integrated with Cashfree’s payment gateway solution to open up various forms of payment module for exercise transactions.

- Setup a ‘Virtual Bank Account’ (VBA) for on-platform transactions: EquityList will work with company admins to setup a VBA, with the payment gateway providers, within 48 hours to ensure that the fund flows directly into the company’s bank accounts.

- Automated reconciliation: Reconciliation of payments done via the payment gateway will automatically get reconciled - saving your finance team time and effort in going through bank statements!

(Note: We currently provide payment gateway solutions for companies with Indian operations only. If you're an EquityList customer who'd like to opt-in to the payment gateway solution and have us setup your VBA, then please reach out to us at help@equitylist.co.)

1. Overall improvements to share transfer flow

Under Cap Table > Shares > ‘Share Certificates' tab, whenever a new ‘Transfer’ is initiated, our platform has now put in fields to capture ‘Reason’, ‘Round Stage’, and ‘Transfer Date’ (’Rule 144 Date’ for US companies), applicable to all shareholders.

- On a successful transfer, you will see the particulars mentioned under the ‘Transferred To’ section and the original share certificate will be marked as canceled.

2. Bulk invite shareholders to their EquityList dashboards

You can now bulk invite shareholders to their EquityList dashboards to track all the securities assigned to them.

- Add a custom message that will be part of the invitation email

- Track the shareholders that you have invited

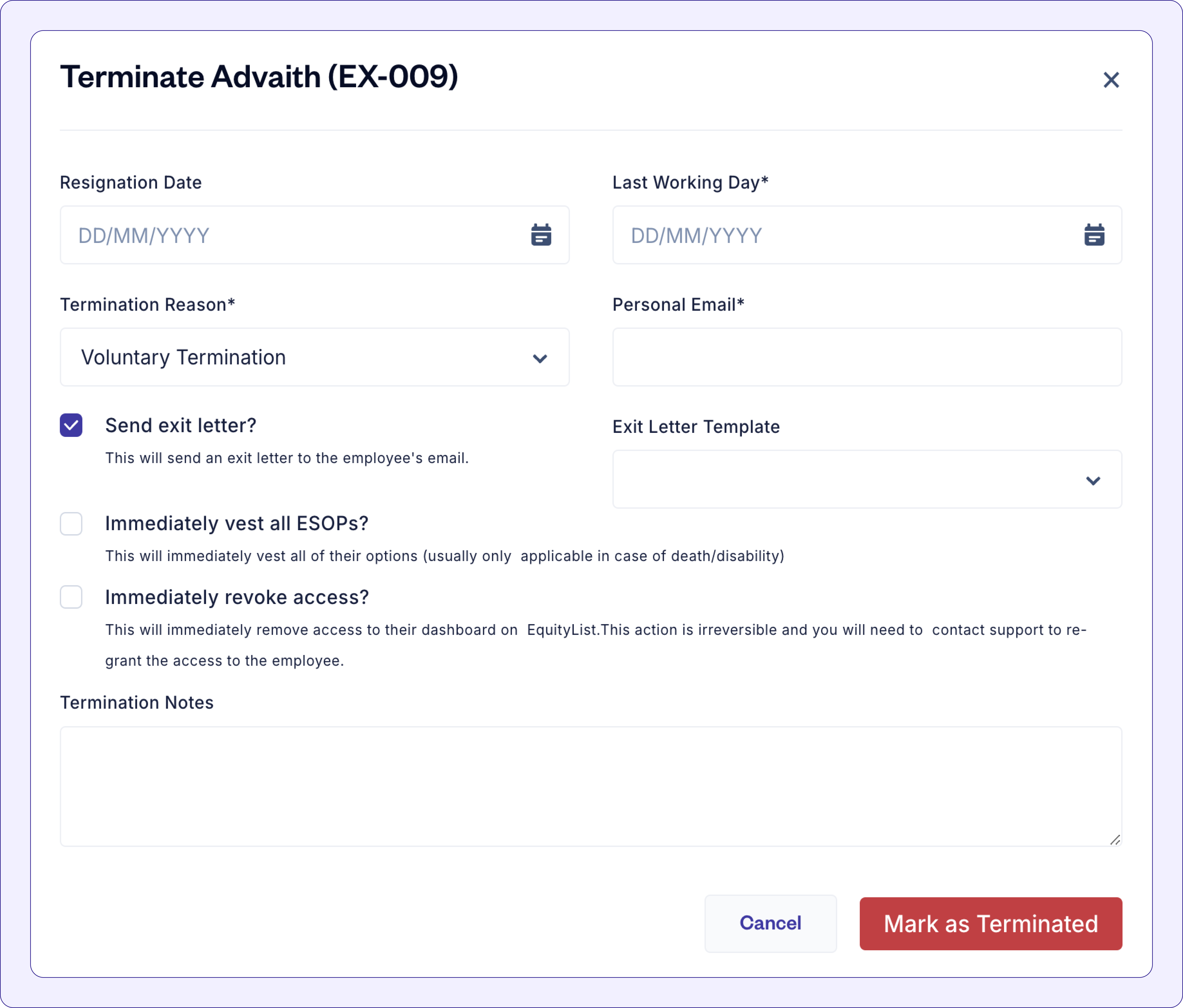

- When terminating an employee on EquityList, by default a system-generated email gets sent to the exited employee, summarizing their vested units.

- Now, you can also choose to send exit letters which get triggered on resignation, summarizing the stakeholder's vested options and requesting a counter-signature.

- Admins can also create their own exit letter templates under Legal > Templates.

Cap table administrators will now feel a lot more equipped when looking to study their cap tables in detail.

We’ve applied enhancements to:

- Search: Directly search for the cap table entity from the search bar on top.

- Filters: Apply filters to the cap table to view shareholders, employees, option pools, or even at a share class level.

- Reporting: Enhanced cap table reports, formatted for clarity.

[Psst, we’ve also upgraded the Cap Table > Fully Diluted page to load faster. Try it out!]

[Note: You’ll now find Vesting Templates under Equity Awards in the left-hand menu.]

We have completely revamped vesting templates for our customers to support customization and complex vesting schedules.

1. When adding/creating a new vesting template, you now get:

- Customizable vesting schedule: Select between ‘Standard’ and ‘Custom’ types to create the desired schedule.

- New duration intervals: ‘Vesting Duration’ and ‘Cliff Duration’, now both support daily, monthly, quarterly, and yearly durations.

- Immediate vesting: When issuing a new grant, you can select to immediately vest a percentage of the total grant, e.g. “20% immediate vesting upon grant date and 80% split across 4 years.”

2. Introducing ‘Performance Conditions’:

You can now create multiple performance conditions for vestings and link them with a vesting template.

This feature enables batch creation of grants tied to specific performance requirements, including customizable payout ranges.

E.g. “$3M ARR by Q4 2024, vesting payout between 50% and 100%.”

You can also realize these conditions by specifying the vesting payout (percentage of goal achieved) to vest units in bulk for all grants linked to a performance condition template.

3. Creating custom vesting templates:

You can now completely customize your vesting templates as well. This includes:

- ‘Performance Based Vesting’: Define milestones, vesting percentage, and link performance conditions.

- ‘Time Based Vesting’: Create your own time-based vesting schedules and link them to a performance condition as well.

[Note: When linked with a performance condition, the vesting will only be completed once both time duration and performance conditions are met.]

- ’Manual Vesting’: Create templates where you get to decide when to vest. With this option, vesting events occur only when you manually trigger them at the grant level.

Give it a try!

.webp)

.svg)

.svg)